A freelancer can join the Korean Social security program(4 major insurances)?

Employer reluctantly make an employment contract for a regular employee but a freelancer, is there any reason? There could be several...

Did you apply for National pension deductions when filing your 2022FY income tax?

A freelancer workers can apply for National pension deductions when calculating their income tax. The National Pension system in Korea is...

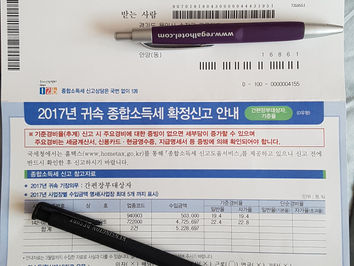

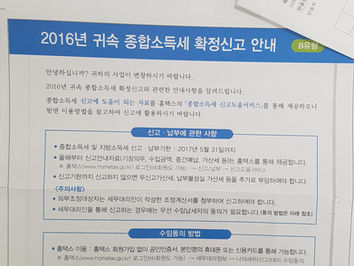

Global Income Tax Return

I think you may get this NTS letter recently and need to prepare return and pay taxes by the end of May. Most of salaried employee who...

Retirement Allowance for E-2 Visa Holder

Recently a court recognized English teacher(E-2 Visa Holder) at a private Hagwon as employees entitled to retirement allowance, rejecting...

Individual Income Tax Return(종합소득세)

expat tax return in korea