The Importance of Timely Tax Returns in Korea: A Comprehensive Guide

In South Korea, according to the National Tax Service (NTS), there are 9.6 million businesses, and 7.4 million of them are...

Interim Tax Return for the Individual Income Tax for the 1st half of 2018FY

Please pay the interim individual income tax by the end of Nov., it's around half amount of the March return. Around 14bil....

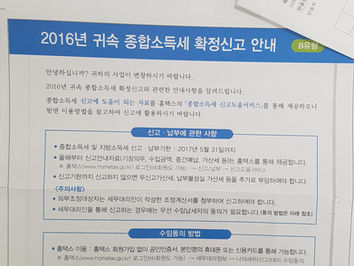

Individual Income Tax Return(종합소득세)

expat tax return in korea

Saving Your VAT

I’d like to introduce how we can save your VAT through your credit/debit card, it looks like a bit complicated to register your credit...

Car Allowance

I’d like to let you guys know about the non-taxable income salaries for employees, have you ever heard about it? I’m not talking about...

Accountant in Korea

In the United States, people can prepare tax returns without the need of a license. In which case an EA (Enrolled Agent) and a CPA...

Individual Income Tax

Many expats have recently come to me with questions about the Individual Income Tax as they prepared their Year-end Settlement documents...

Filing an Income Tax Return

Around eight million sole proprietors are preparing the Global Income Tax Return in May. Are you? A lot of expats who are working in a...

5 Things to Check When Filing Taxes in Korea

1. Are you salaried as a regular employee? You don’t need to file taxes if you’re hired by an employer as a regular employee (정규직, i. e.,...

Individual Income Tax in Korea

Over the years, I have gotten a lot of questions about Individual income tax; most frequently, expats ask about the year-end settlement...