Understanding the Korean Tax System: A Comprehensive Guide for Expat Taxpayers

Korea's tax system can be confusing, especially for expat taxpayers. One common question revolves around the fluctuating tax payments and...

The Importance of Timely Tax Returns in Korea: A Comprehensive Guide

In South Korea, according to the National Tax Service (NTS), there are 9.6 million businesses, and 7.4 million of them are...

Demystifying preliminary Value Added Tax Filings in South Korea

One of my friends send me an email with a VAT bill issued by the tax office he belonged. *He told me it seems like wrong since he didn't...

Mandatory issuance of e-Tax invoices

From July 1, 2022, the subject of mandatory electronic tax invoice issuance will be expanded. As of 2021, the total amount of taxation...

VAT Return for the 2nd half of 2020 FY

NTS(National Tax Services) announced on Jan. 6 to delay the due date for a month for every "Sole-proprietorships" due to the pandemic...

Questions to Korean Tax Bureau

I think a lot of foreigner may have a lot questions on Korean tax system and no idea how to approach to get an answer. The below web...

Not-For-Profit Organization

Set up a not-for-profit organization is a good idea for getting a E-7 VISA in Korea, it's called a liaison office or representative...

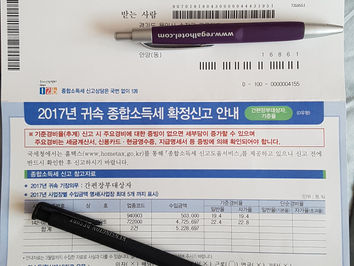

Global Income Tax Return

I think you may get this NTS letter recently and need to prepare return and pay taxes by the end of May. Most of salaried employee who...

VAT Returns

You may get the attached letter from the NTS, this is the notice letter for the last VAT return of 2017FY. Every company need to file VAT...

Year-end tax settlement(연말정산)

2017 Year-end tax settlement data at the Hometax will be ready from Jan.15, and you can download all of deductible items there and submit...