Deductions for Monthly Rent

From 2021FY, NTS decide that you foreigners can claim this deductions from your salary income during your year-end settlement process....

Global Income Tax Return for 2019FY

Every resident who earned other than salary income in Korea for 2019 FY need to file tax return by the June 1, 2020 and must pay taxes by...

Year-end Tax Settlement Schedule

if you're a salary incomer, sooner or later from Jan. 15, 2019, you guys can download all of deductible items from the Hometax(홈택스:...

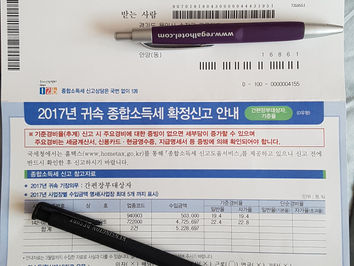

Global Income Tax Return

I think you may get this NTS letter recently and need to prepare return and pay taxes by the end of May. Most of salaried employee who...

Tax Refund from Year-end tax settlement

Are you married with kids and alone in Korea? You can deduct dependents here in Korea from your salary income. Please visit the below...

Year-end tax settlement(연말정산)

2017 Year-end tax settlement data at the Hometax will be ready from Jan.15, and you can download all of deductible items there and submit...

Payroll Service in Korea

Jz provide the payroll service for employees who hired in Korea for your operation. Your company is not necessarily established already...