Navigating the Realm of Electronic Tax Invoice: Korean Tax Compliance Unveiled

Introduction

Are you currently engaged in business operations in Korea or contemplating such a venture? If your answer is affirmative, you have undoubtedly confronted the intricacies of Korean tax law, particularly in the realm of electronic tax invoices (전자세금계산서) and cash receipts (현금영수증). In this comprehensive article, we shall embark on a journey to demystify the process of issuing electronic tax invoices, elucidate the corresponding legal obligations, and delve into the intricacies of reporting procedures.

The First Challenge: Acquiring the 공동인증서 (Public Key Certificate)

Foreign entrepreneurs are greeted with their first challenge on this path – obtaining the indispensable digital certificate known as the 공동인증서 (Digital Certificate). To secure this certificate, one must complete the registration process with the National Tax Service through the Home Tax portal (www.hometax.go.kr). It is imperative to acknowledge that this certificate holds a pivotal role in your business endeavors, extending its utility beyond matters of taxation. Furthermore, we will delve into strategies for optimizing this certificate, enabling it to serve various essential functions while simultaneously reducing costs.

But our assistance does not conclude here. Jz Associates stands ready to support you throughout your business journey in Korea, offering a comprehensive array of services, including application of corporate and personal credit cards, and more. If you seek further information or have additional questions, please do not hesitate to reach out to us at jz@taxjz.com or schedule a consultation with Jz. Let us commence our exploration of the intricate world of electronic tax invoices and Korean tax compliance.

Understanding Electronic Tax Invoices

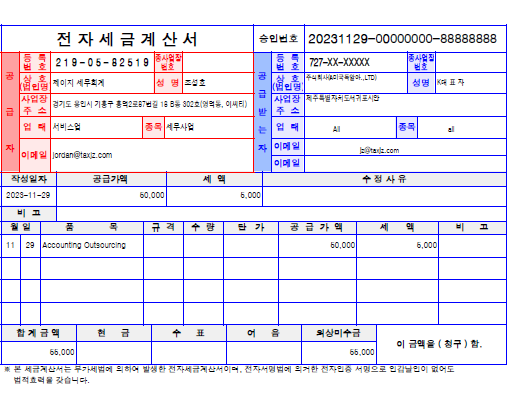

Before delving into the specifics, it is crucial to establish a clear understanding of what electronic tax invoices represent and their significance within the Korean context. Electronic tax invoices are official documents employed in commercial transactions to document the exchange of goods or services. In Korea, they bear legal necessity for various types of businesses under the purview of diverse tax laws, including the Value Added Tax (VAT) Law, Income Tax Law, and Corporate Tax Law.

The Significance of Electronic Tax Invoice Compliance in Korean Tax Law

In Korea, the issuance of electronic tax invoices is obligatory for distinct categories of businesses, depending on the relevant tax legislation that governs them. Here is a categorical breakdown:

Individual Entrepreneurs(Sole-Proprietorship): According to Article 162-3 of the Income Tax Law, individual entrepreneurs are mandated to issue electronic tax invoices from 2024 FY if it's sales amount was more than 100 mil.won in 2023FY.

Corporate Entities: Corporate entities, subject to Article 117 of the Corporate Tax Law, are likewise compelled to issue electronic tax invoices.

Acquiring the Public Key Certificate

For foreign entrepreneurs, procuring the requisite digital certificate, known as the 공동인증서 or Digital Certificate, marks the initial hurdle in this process. The following steps elucidate the acquisition process:

Registration with Home Tax: Initiate the process by visiting the Home Tax portal at www.hometax.go.kr. Depending on your business structure, complete your registration either as a corporate or individual taxpayer together with your check/credit card for Sole-proprietorship.

Application for Bank Account: During the registration, you will have the opportunity to apply for your digital certificate. Remarkably, this certificate serves a multifaceted purpose, including the facilitation of online banking (인터넷뱅킹).

Distinction Between Banking and Tax Certificate: It is imperative to discern that the digital certificate serves dual roles – one for banking and the other for tax invoice issuance. Each certificate incurs a cost of 4,400 KRW and boasts a validity period of one year.

One-Time Password (OTP) Generator: To streamline online banking processes, consider the acquisition of an OTP Generator alongside your certificate. This modest investment will enable efficient management of your accounts.

Maximizing the Utility of the Public Key Certificate

The 공동인증서 transcends its role in tax-related matters, emerging as a Swiss army knife of sorts for a myriad of business operations in Korea. Its versatile applications encompass for example:

Insurance Management: Employ it for the efficient management of insurance policies, ensuring comprehensive coverage for your business.

Credit Card Management: Simplify credit card management tasks through the utilization of your certificate.

Vital Transactions: Leverage it for pivotal functions, including the management of social insurance and other essential business operations.

Cost Savings Through Shared Certificates

Traditionally, OTPs (One-Time Passwords) for your certificate necessitate the involvement of an account manager. However, the practice of sharing this certificate with your tax agent or representative can streamline administrative processes and yield cost savings. Recent developments have also witnessed a transition from token-type to card-type certificates. The icing on the cake? Jz's clients receive these card-type certificates free of charge.

Jz Associates: Your Trusted Partner in Korean Business Ventures

Jz Associates extends its unwavering support to facilitate your journey through the intricacies of Korean business. Our services encompass not only tax-related matters but also essential offerings, such as corporate credit card issuance, designed to enhance your business operations in Korea. For any inquiries or further information, do not hesitate to reach out to us at jz@taxjz.com or schedule a consultation with Jz.

Your success in Korea is our paramount concern.

Frequently Asked Questions (FAQs)

Q1: Must I issue electronic tax invoices for all my business transactions? A1: Indeed, electronic tax invoices are obligatory for qualifying business transactions in Korea, as stipulated by the pertinent tax legislations.

Q2: Can foreign entrepreneurs engaged in business in Korea apply for the 공동인증서? A2: Absolutely! Foreign entrepreneurs are not only eligible but should apply for the 공동인증서 to align with Korean tax regulations.

Q3: How can I leverage the certificate for purposes beyond tax invoicing? A3: The certificate's versatility extends to functions such as banking, insurance management, credit card handling, and various other essential tasks for your business in Korea.

Q4: Are there associated costs for managing OTPs for the certificate? A4: Ordinarily, OTP management necessitates an account manager. However, the practice of sharing the certificate with your tax agent or representative can yield cost savings.

Conclusion

While navigating the intricate landscape of electronic tax invoices and Korean tax compliance may initially appear daunting, armed with the right knowledge and support, you can confidently steer through these waters. Keep in mind that Jz Associates stands ready to assist you at every juncture, offering not only tax-related services but also indispensable business support, including credit card issuance. Whether you are a seasoned business owner or embarking on your entrepreneurial journey in Korea, seize the resources at your disposal to ensure seamless business operations while adhering to Korean tax regulations. Should you require further clarification or assistance, do not hesitate to contact us at jz@taxjz.com or schedule a consultation with Jz.

Your success in Korea remains our foremost priority!

Comments