Understanding Tax Deductible Receipts for Business Expenses

- Joseph Zoh

- Dec 26, 2023

- 2 min read

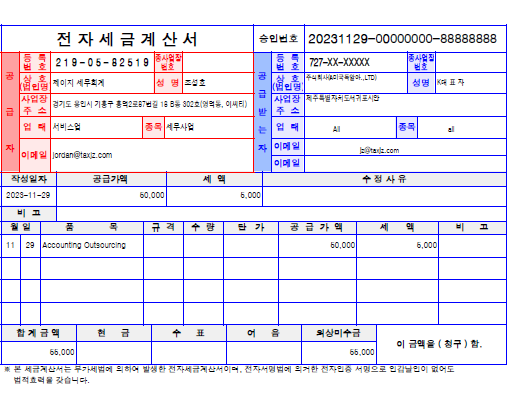

To ensure compliance with tax laws and maximize deductions on business expenses, it is essential to obtain proper receipts. These include credit or check card receipts, cash receipts, and specifically, tax invoices, as dictated by the Value-Added Tax (VAT) law, which typically includes 10% of the value of the product or service.

For companies registered with the court, regardless of paid capital, and for sole proprietors with annual sales exceeding 100 million won in 2023FY (depending on business type), issuing electronic tax invoices is mandatory in 2024FY. Non-compliance leads to fines. Electronic tax invoices require a digital certificate for Issuance of tax invoice, distinct from the one for internet banking:

Essential details for electronic tax invoices include:

Issue Date: Corresponds to the recognition of sales/income, or when the product/service is delivered or completed.

Amount: The value of the product or service.

VAT: 10% or 0% of the product or service value.

Product/Service Name: Description of what is provided.

Client's Email: For sending the tax invoice.

Upon issuance, these invoices are uploaded to the National Tax Service (NTS) server and sent to the client’s email. They can be downloaded from the NTS server for VAT filing purposes, done quarterly for companies and semi-annually for sole proprietors.

Manual tax invoices (세금계산서) issued by sole proprietors require verification of the supplier’s tax ID through the NTS website. Electronic tax invoices cannot be issued or uploaded without a valid tax ID.

When purchasing items like raw meat or vegetables, a different kind of tax invoice (계산서) can be requested. This invoice is not subject to the 10% VAT but is necessary for tax-deductible receipts under VAT law. It's important to distinguish between these invoices and other documents like 거래명세표 or 거래명세서, which are packing or delivery lists and not valid for tax deductions. The 계산서 cannot be downloaded from the NTS server if issued by a sole proprietor manually.

It is advisable to request these tax-deductible receipts from suppliers, even if it involves a 10% additional cost. Electronic tax invoices can be issued for a fee ranging from 200 to 1,000 won via specific websites, but are available for free through the "HOME TAX" website.

For more details, please feel free to reach out at jz@taxjz.com or If you would like a free consultation with an English-speaking Consultant/Accountant in Korea, please schedule a call at: Schedule a Call with Jz

Recent Posts

See AllAcquiring an existing corporation in Korea involves several critical considerations to ensure a smooth transition and compliance with...

Expansion of Mandatory Electronic Tax Invoicing in South Korea: Lower Thresholds for Compliance Korea continues to advance its electronic...

Korea, an international business hub, offers a vibrant yet intricate banking system for non-residents and foreign companies. Navigating...

Comments